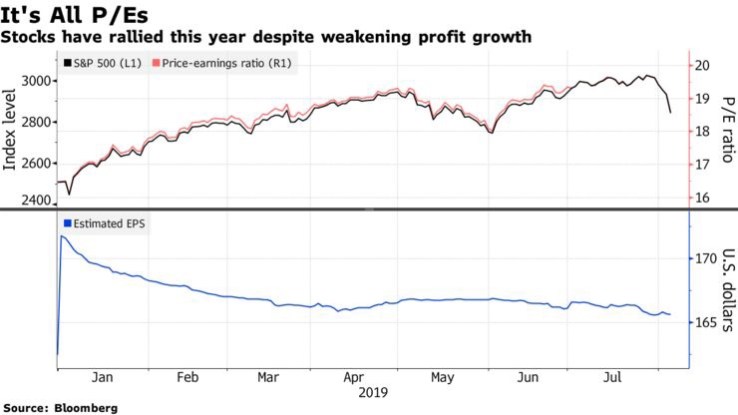

Bloomberg: Tobias Levkovich, the firm’s chief U.S. equity strategist, cut his earnings forecast for S&P 500 companies this year by $3.80 to $166.20 a share. He’s long held the view that analysts are too optimistic about companies’ abilities to retain high margins. His latest move, which included a $4.25 cut to 2020’s forecast as well, puts his target for next year’s annual growth at 4.8%, less than half the Wall Street average

The swift escalation of President Donald Trump’s trade war with China suggests the battle is likely to drag on until U.S. presidential elections next year, according to Levkovich. The prolonged uncertainty will cloud a profit picture that’s already worsening amid a global slowdown, he said

Levkovich is sticking to his year-end target of 2,850 for the index. While profit growth is set to slow, tame inflation makes stocks attractive, he said

The upside seems to be limited for stocks, but investors should consider buying the dip, particularly should Trump dial back his hard stance on trade, Levkovich said

“The resultant sharp market retreat puts pressure on Donald Trump since he has touted the S&P 500 as being a key gauge of his economic stewardship,” he wrote. “Thus, the reaction of equity prices might force the White House to lower the protectionist rhetoric and seek out some sort of compromise position.”

Blue Phoenix Financials: The Key In This Environment Is To Buy Cos That Are Trump And Recession Proof. Email Now To Access Our Next Algo Trade Alert: inquiries@ppchk.net