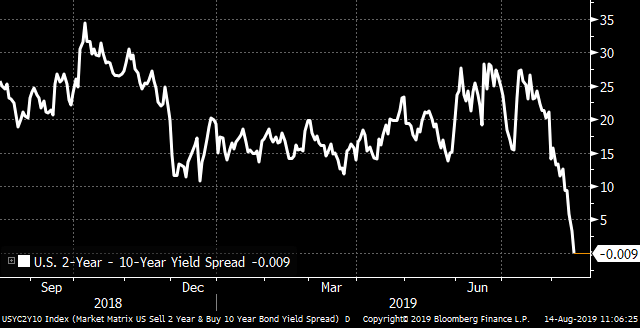

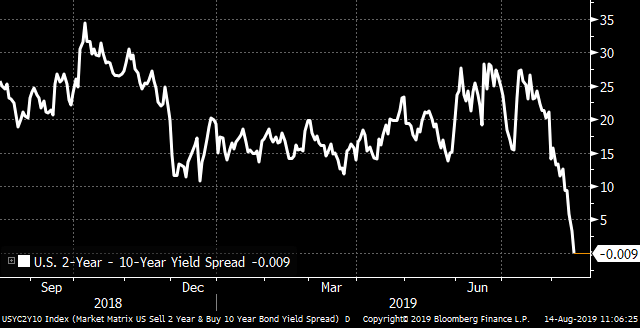

A yield curve inversion when a longer-term bond yield sinks below that of a shorter-term bond’s yield. The two most watched sections of the U.S. Treasury curve—the difference between 3-month and 10-year yields and the difference between 2-year and 10-year yields—have now inverted, though the latter only inverted briefly

The yield curve, however, may be a less reliable indicator than in the past. Our Algo warns that the Federal Reserve’s bond buying, which may have distorted the market, as one reason it might be different this time. Investors should also take note that recent economic data has held up despite the inversion of the 10-year/three-month portion of the curve

In a note released Wednesday morning, Tom Porcelli, chief U.S. economist at RBC Capital Markets, highlights how this instance is different from past yield curve inversions. In the past, the curve was a gauge of U.S. economic growth, but these days it is being driven by what’s happening around the world. “What this means is the United States is able to finance relatively good rates of DOMESTIC growth at GLOBALLY suppressed interest rates,” Porcelli writes. “This type of dynamic has historically been very positive for asset inflation…So, no, we are not on recession watch because of this dynamic.”

Jay Bryson, acting chief economist at Wells Fargo Securities, argues that the 10-year yield would be much higher without the Fed’s bond buying. The central bank still has more than $2 trillion of Treasuries on its balance sheet, which has made the 10-year yield 0.25 to 0.5 percentage point lower than it would be otherwise, by Bryson’s math. “In other words, the yield curve may not be inverted at present if not for the Fed’s QE [quantitative easing] purchases on its balance sheet,” he explains

How To Profit From A Recession? Which Companies Will Do Well In A Recession And/Or Stock Market Drop? Email Now To Access Our Next Algo Trade Alert: inquiries@ppchk.net