WSJ: Major U.S. stock indexes fell sharply before clawing back their losses during the afternoon. At 4 p.m. ET, the S&P 500 had fully recovered, gaining less than 0.1% on the day. The Dow Jones Industrial Average recently fell 22 points, also less than 0.1%, after dropping 589 points in early trading. The Nasdaq Composite rose about 0.4%. The large swings come a day after stocks rebounded to break a streak of declines amid trade tensions

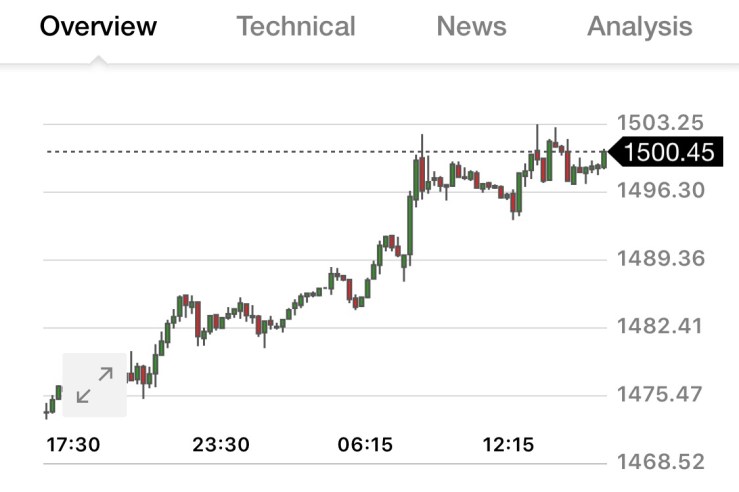

Rate Cuts In Thailand, India and New Zealand caused investors to buy government bonds and gold—assets considered relatively safe—while selling U.S. stocks and oil. Gold prices topped $1,500 a troy ounce for the first time in six years. Meanwhile, U.S. crude futures dropped 4.7% to their lowest close since January

The yield on 10-year Treasurys dipped below 1.6% on Wednesday before settling at 1.675%. That is down from 1.740% on Tuesday, when it hit its second-lowest level in 2019. Bond yields and prices move in opposite directions

Some analysts said the Treasury rally could continue, driven by slowing economic activity in the U.S. and easing monetary policy globally. Government-bond rates have been negative in Japan off and on since 2016 and have hit record lows below zero in Germany

Why Did The Market Recover? U.S. indexes pared some of their big declines as St. Louis Fed President James Bullard said Wednesday that he thinks the central bank “can afford to do more policy adjustments.”

Asked Wednesday morning about the recent volatility in markets, President Trump said: “I think the market reaction is to be expected. I might have expected it even more. At some point, as I said, we have to take on China. They’ve been taking us to the cleaners for 25 years.”

Meanwhile, he doubled down on hammering the Fed, tweeting that the central bank had made a mistake by increasing interest rates too much

Trump: “They must Cut Rates bigger and faster, and stop their ridiculous quantitative tightening NOW,” Mr. Trump said on Twitter