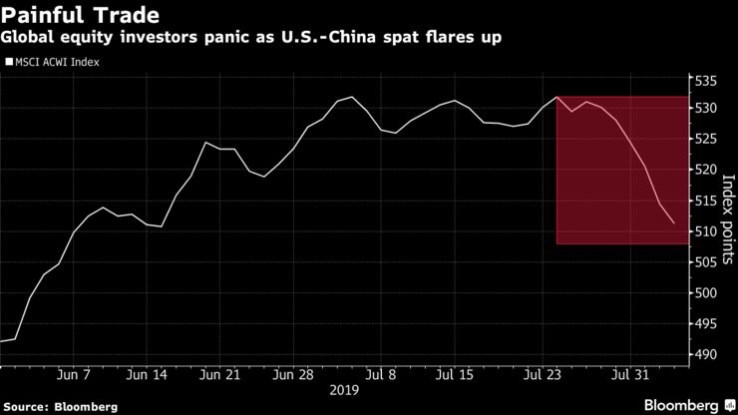

Bloomberg: Labour leader Jeremy Corbyn said on Monday he would call for a vote of no-confidence at “an appropriate very early time” once Parliament gets back to work in September. If Corbyn succeeds, then a general election would be triggered

Dominic Cummings, a key adviser to Johnson and a major player in the 2016 referendum campaign, has told officials that even if Parliament forces an election, it’s already too late to stop a no-deal split, according to the the Telegraph newspaper

Germany doesn’t believe Boris Johnson will be able to make good on his threat to take Britain out of the European Union without a deal. German officials said they expect Parliament to thwart any attempt to rip the country out of the bloc without an agreement to smooth the process. Irish officials take a similar view

In Berlin, officials see elections as a safety net. They expect a general election would strengthen the pro-EU parties, raising the possibility of a new government led by a coalition of Labour and Liberal Democrats

If the opposition fails to prompt an election, then lawmakers could try other methods to prevent a no-deal split — using the tools of Parliament and the courts

EUR/GBP bulls seem to be gearing up for an assault on 0.9307 2017 peak • Especially as the market continues to trade well above the 0.9106 Fibo • 0.9106 Fibo is a 76.4% retrace of the 0.9307 to 0.8456 (2017 to 2019) low • Now To Access Our Next GBP Algo Trade Alert: inquiries@ppchk.net