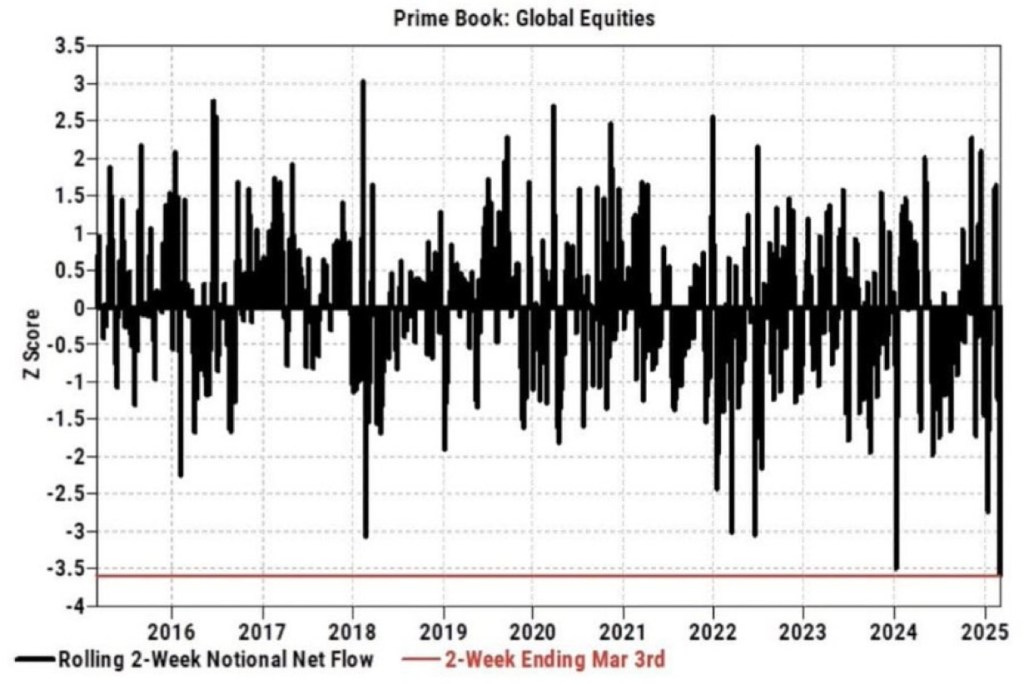

The liquidation has generated the lowest rolling 2-week notional net flow Z-score since records began, indicating an extraordinary level of stock dumping

The S&P 500 experienced a drop of 3.5% over these two weeks, with trading volumes increasing by 25% from the previous period

The Dow Jones Industrial Average fell by 3.2%, and the NASDAQ Composite Index declined by 3.8%, both reflecting similar trends in trading volumes

Discover how we can elevate your portfolio and deliver exceptional growth. NEW Monthly Payout Of At Least 0.5% In US Dollars

Contact Us: bit.ly/Alpha-Binwani-Capital

Website: alphabinwanicapital.com

#HedgeFunds #GlobalStocks #MarketTrends #InvestmentStrategies #FinancialNews