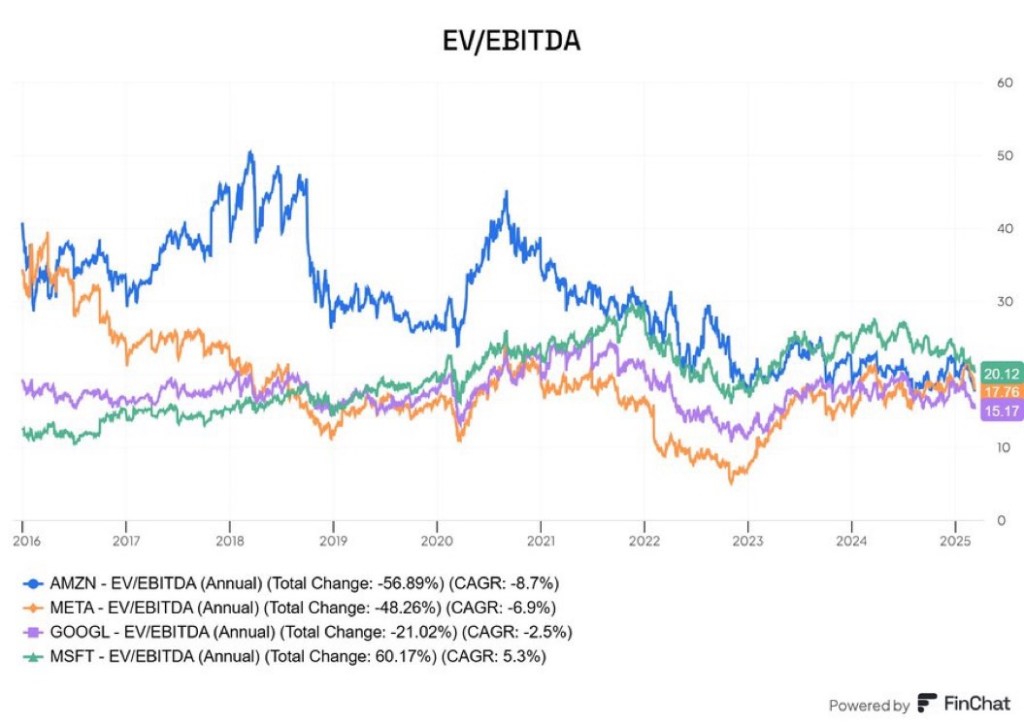

Amazon (AMZN): Current EV/EBITDA is 17.04, which is indeed on the lower end of its 10-year range (11.14 – 21.68)

Meta Platforms (META): Current EV/EBITDA is 16.07, which is below its 10-year average of 18.34

Alphabet (GOOGL): Current EV/EBITDA is 15.21, which is at the lower end of its 13-year range (11.14 – 21.68)

Microsoft (MSFT): Current EV/EBITDA is 26.06, which is actually higher than the 10-year average of 20.27

Discover how we can elevate your portfolio and deliver exceptional growth. NEW Monthly Payout Of At Least 0.5% In US Dollars

Contact Us: bit.ly/Alpha-Binwani-Capital

Website: alphabinwanicapital.com

Facebook Group: bit.ly/AlgoFBGroup

#InvestmentInsights #TechValuations #MarketTrends #EquityAnalysis #FinancialMetrics