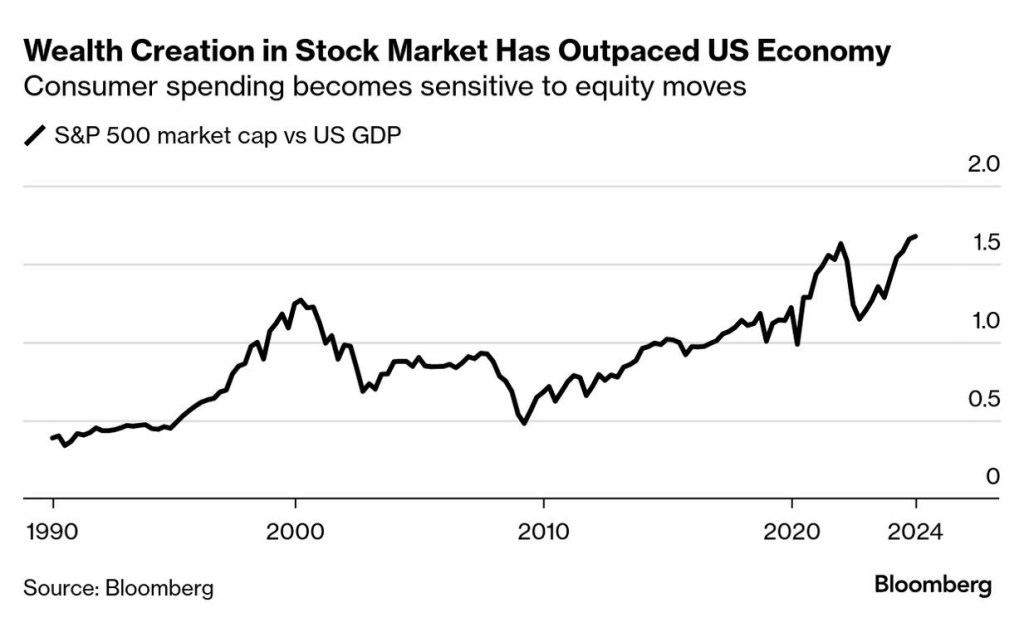

The Wealth Effect and Economic Impact

The wealth effect suggests that as people’s perceived wealth increases, they tend to spend more, stimulating economic growth. Conversely, when asset values decline, consumers may reduce spending, potentially leading to economic contraction.

Current Market Situation

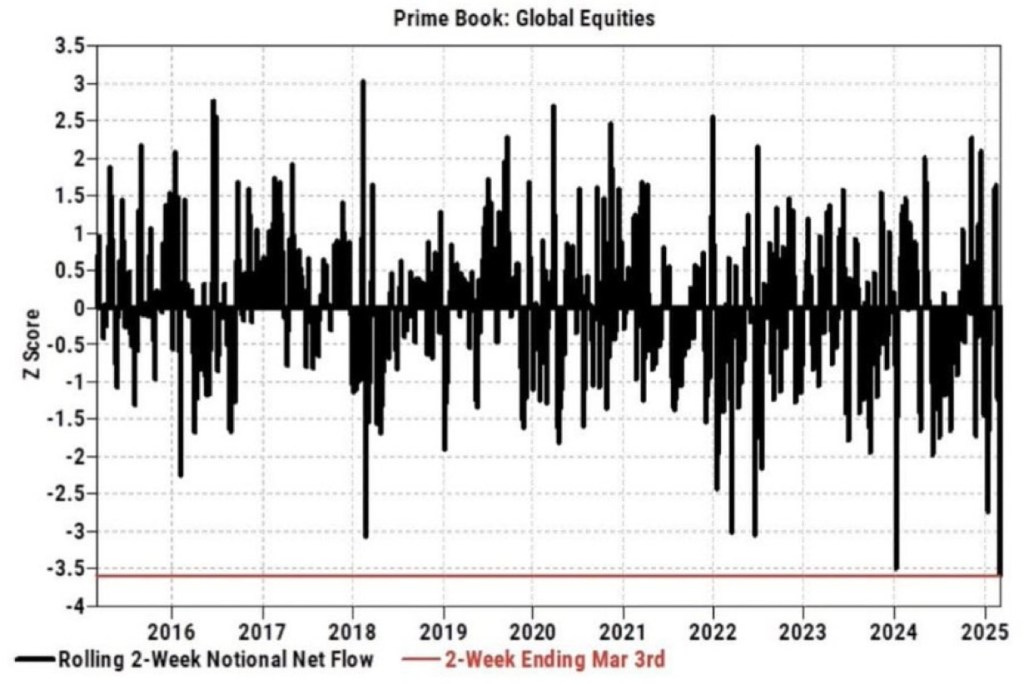

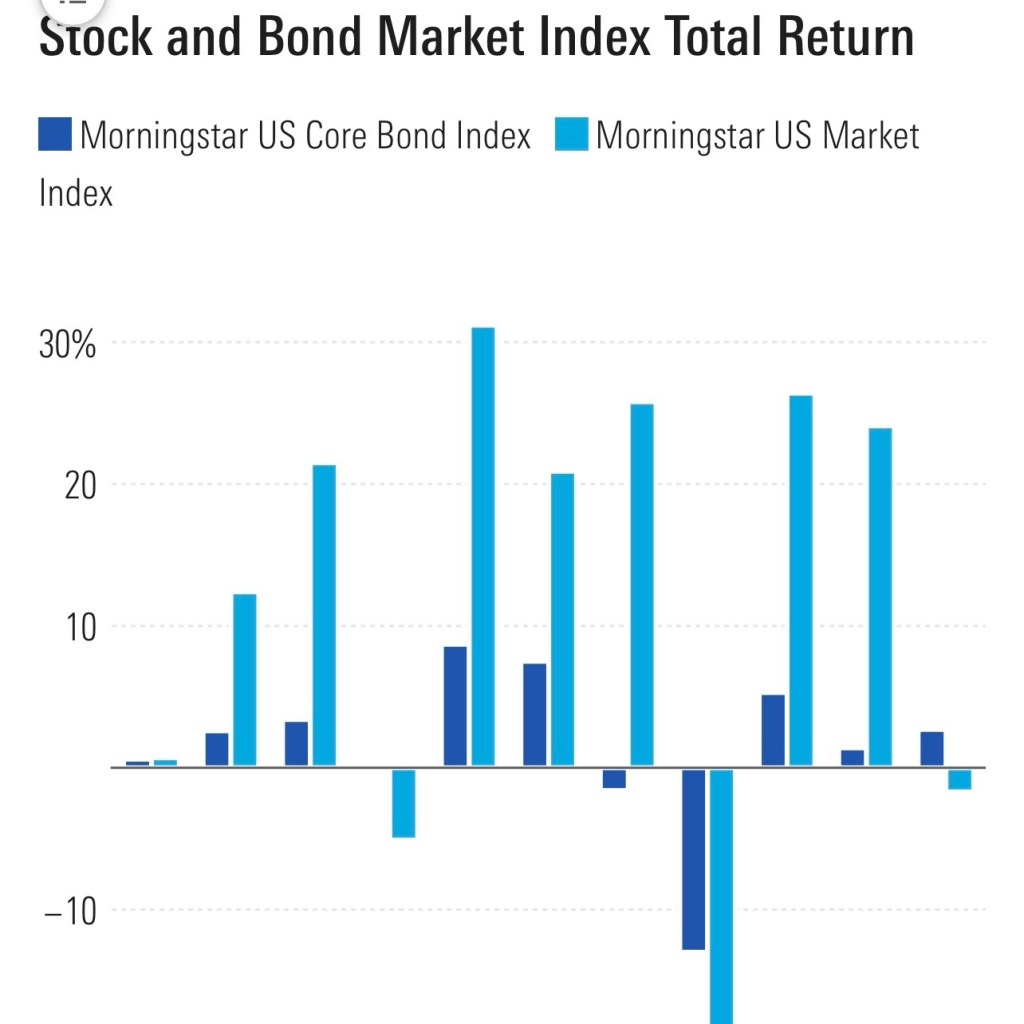

Wall Street traders experienced the largest cross-asset losses since the Federal Reserve’s monetary tightening campaign peaked in 2023. The sell-off has been attributed to various factors, including:

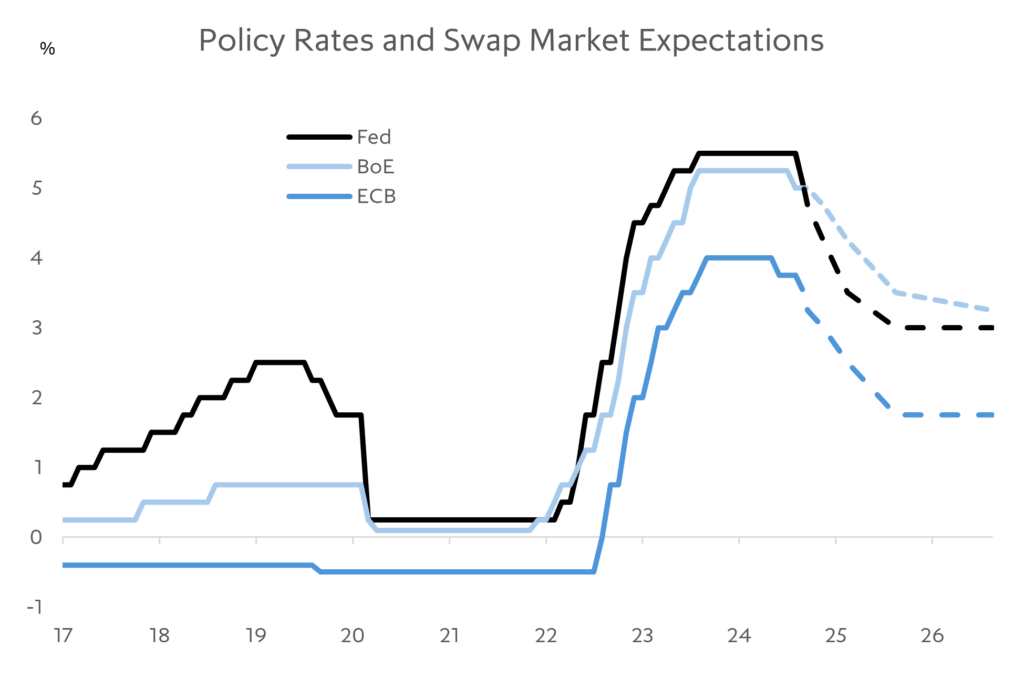

• Tariffs and trade tensions • Softening economic growth • Potential revitalization of Europe • Concerns about inflation and interest ratesEconomic Vulnerability

The speed and scale of the recent market plunge serve as a reminder of the markets’ potential to trigger economic instability. Doug Ramsey, chief investment officer at Leuthold Group, warns that the current economic expansion may not withstand a stock market correction exceeding 12-15%.

Potential Consequences

If the market downturn persists, it could lead to:

1. Reduced consumer spending 2. Decreased business investments 3. Potential job losses 4. Overall economic slowdownMitigating Factors

While the situation is concerning, it’s important to note that:

1. The current losses are not yet at panic levels 2. Market safeguards, such as circuit breakers, exist to prevent extreme crashes 3. Central banks and government policies can help stabilize markets during turbulent timesDiscover how we can elevate your portfolio and deliver exceptional growth. NEW Monthly Payout Of At Least 0.5% In US Dollars

Contact Us: bit.ly/Alpha-Binwani-Capital

Website: alphabinwanicapital.com

#WallStreetSellOff #EconomicImpact #WealthEffect #MarketDownturn #CrossAssetLosses